Payroll tax : Photo Gallery

Payroll tax : Videos

Payroll tax : Latest News, Information, Answers and Websites

WSJ SLAMS House Republicans For PAYROLL TAX Cut Debacle, Says They Are Throwing 2012 Election To Obama

The conservative Wall Street Journal editorial board is slamming House Republicans today for their hard-line position on the Payroll tax cut, writing that GOP lawmakers are throwing the 2012 election to President Barack Obama before it even begins. House ...

PAYROLL TAX cut impact: What if its not extended? - Dec. 16, 2011

NEW YORK (CNNMoney) -- In two weeks, the Payroll tax cut that has saved workers an average of $1,000 this year will expire -- unless lawmakers in the next ...

Obama, Boehner lock horns in PAYROLL TAX fight | Reuters

14 hours ago ... WASHINGTON (Reuters) - President Barack Obama demanded on Tuesday that Republicans in the House of Representatives pass a ...

What is the difference between PAYROLL TAX, and federal tax?

Obama keeps saying some people work and pay no federal tax. He says they pay Payroll tax??? We have state tax, social security tax, medicare tax, federal tax, disability tax. So what is Payroll tax???

Answer: shows he has not a clue about the middle class working family.

Its the Federal Withholding Tax on the pay stub that most working class folks bring home. The very fact that all along they have made a difference in their speech about taxes and Payroll taxes says they don't understand how it works.

Lord help us if he wins.

I've paid payroll withholding tax all my working days,

and at the end of the year, come April 15th when I file my 1040 Tax Return, sometimes I owe even more than was withheld from my paycheck and guess what?

I don't come close to making $250,000, or $200,000 or $150,000 or $100,000 or,

well, you get the picture.

John McCain said Obama's tax plan would tax those making as little as $42,000, well, that's closer to my income than $100,000.

I'd love to know how Obama figures 95% of us don't pay income tax.

I pay income tax on my income, all my friends and family pay taxes and none of us are "rich". How about you?

He could not be so uneducated as to believe that the dollar withheld from a paycheck for income tax is any different than the dollar paid with estimated tax or a tax return for income tax; neither dollar stays with the worker's family, it goes to the government.

I believe Obama is intentionally misleading people.

Category: Elections

where can I get a PAYROLL TAX deduction guide for Ill?

Im starting a small business & need a Payroll tax guide to pay salaries. I remember having a book when I did payroll at another job. I need to know where I can purchase one for the state of Illinois.

Answer: www.iltax.com

Category: United States

EDITORIAL; The Middle-Class Agenda

Earlier this month, President Obama delivered his first unabashed 2012 campaign speech . Unlike his opponents, Mr. Obama acknowledged the ravages of income equality, the hollowing out of the American middle class. There is no hyperbole in the urgency he conveyed about “a make-or-break moment for the middle class, and for all those who are

House GOP rejects 2-month PAYROLL TAX cut

WASHINGTON — The House Tuesday rejected legislation to extend a Payroll tax cut and jobless benefits for two months, drawing a swift rebuke from President Barack Obama that Republicans were threatening higher taxes on 160 million workers on ...

the republicans are blocking the PAYROLL TAX cut how do you feel about getting a tax increase?

the Payroll tax cut expires in jan and the gop is blocking its renewal. this represents a loss of 1500 ot most families.

Answer: It was a stupid and irrational tax cut in the first place, that has only served to reduce Social Security revenues and cause an even bigger deficit between SS revenue and SS payouts.

It was not smart (as if anything Democrats do is smart - LOLZ). And the only reason to keep it is political.

I will have to assume you haven't the intelligence to realize you are being played.

Category: Other - Politics & Government

Republicans Say Congress Will Pass PAYROLL TAX Cut Extension ...

Dec. 12 (Bloomberg) -- Senate Minority Leader Mitch McConnell said Congress will reach an agreement that extends the Payroll tax cut even as he defended ...

Does anyone know when the new PAYROLL TAX for national health insurance, estimated at 7 percent - will start?

I heard the new Payroll tax starts in 2011 - Does anyone know for sure?

Answer: Social Security and Medicare are 7.65%, so this is really going to hurt bad!!!! Hope the dems still love their messiah when they see that first pay stub. Also, you will lose the bush tax cuts at the same time.

Category: Politics

What is the difference between an income tax and a PAYROLL TAX?

What is the difference between an income tax and a Payroll tax?

A. Income taxes reduce the demand for harmful goods while Payroll taxes dont affect this demand.

B. Income taxes are collected based on income while Payroll taxes are collected based on wealth.

C. Income taxes are used for a wide variety of government activities while Payroll taxes pay for specific programs.

D. Income taxes increase the purchasing power of the government while Payroll taxes increase the purchasing power of workers.

Answer: payroll-software | payroll-services | payroll-online | payroll:

http://best-antivirus-computer.cn/payroll-software-payroll-services-online-payroll.html

http://best-antivirus-computer.cn/payroll-software-payroll-services-online-payroll.html

http://best-antivirus-computer.cn/payroll-software-payroll-services-online-payroll.html

Category: Other - US Local Businesses

PAYROLL TAX blip will not bust economy: analysts

WASHINGTON (Reuters) - If Congress misses its New Years Eve deadline to renew a Payroll tax cut and jobless benefits by a few weeks or a month, damage to the economy could be reversed in fairly short order, economists and analysts say. As the ...

Extension of PAYROLL TAX Cut Passes Senate - NYTimes.com

WASHINGTON — Capping a year of last-minute, half-loaf legislation, the Senate voted overwhelmingly on Saturday to extend a Payroll tax cut for only two ...

What do you think of a temporary reduction in the PAYROLL TAX as proposed by conservatives?

I was watching Fox News last night where they were throwing around good things the government could do like a temporary reduction in the Payroll tax.

Do you think such a reduction(as opposed to the suspension for new hires this year) in the Payroll tax will do anything to encourage hiring that the above mentioned suspension already hasnt? Or is hiring the lagging aspect of a business where business needs dont change unless business itself does?

Answer: No I don't think that will encourage hiring. Big companies are doing much better right now than they were at the beginning of the recession, with many of them 30% richer and they're still not hiring. Why? The Chamber of Commerce (among others) is spending $1.5M a WEEK lobbying Congress to prevent the slightest step toward economic recovery. Why? Because they don't want Obama to look good before the election. They make money playing with money while millions of Americans suffer. The buzzards!

##

Category: Politics

PAYROLL TAX: Congress opts for partisanship instead of whats best for Americans

We’re watching this again? Really? It’s seemed that the only way Congress can get anything important done this year is to take the nation to the brink of catastrophe and then claw out a compromise at the 11th hour and 59th minute. We saw it ...

McCain to House GOP: This payroll-tax standoff is hurting the party, you know

Is he right? Over to you, WSJ: GOP Senate leader Mitch McConnell famously said a year ago that his main task in the 112th Congress was to make sure that President Obama would not be re-elected. Given how he and House Speaker John Boehner have ...

House Republicans Reject PAYROLL TAX Cut Deal - NYTimes.com

19 hours ago ... The House vote also calls for establishing a negotiating committee so the two chambers can resolve their differences, but the Senate has left ...

Sen. John McCain: PAYROLL TAX Standoff Is 'Harming the Republican ...

We have to recognize reality, and that is we are not going to see the Payroll tax cut expire on the first of January, and we have to accommodate to that reality, McCain observed. It is harming the Republican Party.

Corrections: December 20

FRONT PAGE Because of an editing error, an article on Monday about the standoff in Congress over legislation to extend a Payroll tax cut beyond Dec. 31 misstated, in some copies, the title of Eric Cantor, a Republican who represents Virginia in Congress. As the article correctly noted, he is the House majority leader; therefore he is a

How will the PAYROLL TAX cut extension help foster economic recovery?

Also, why do the Dems think that the Keystone Pipeline is a bad idea if it can employ thousands of people immediately? Is this done out of environmental concerns or is he trying to appeal to environmentalists (then what about his Union supporters)? Does Obama want a Payroll tax extension to cater to the middle class, whose taxes will soar by next year if nothing is accomplished in Congress soon? Will the extension help or hurt the American people?

Answer: Middle class people *spend* their tax cuts, which injects money into the economy. Rich people don't.

Why do we need a pipeline that goes all the way from Canado to Texas? Why not just to a refinery in North Dakota? James Woolsey, the former CIA chief, says that pipelines are a giant "kick me" sign for terrorists.

Category: Government

White House Signals Pipeline Provision Not A Deal-Breaker In ...

Senate leaders reached a tentative agreement Friday night on legislation to extend Social Security Payroll tax cuts and jobless benefits for two months ...

PAYROLL TAX Cut Bill: House Rejects Senate Extension

WASHINGTON -- House Republicans on Tuesday rejected a Senate bill that would have prevented a Payroll tax cut from expiring on New Year's Day, saying they wanted a year-long extension or no extension at all. House ...

PAYROLL TAX: Definition from Answers.com

Taxes levied on employees salaries or net income of self-employed individuals. Social Security taxes are imposed upon employees; self-employed individuals and ...

Representative Sessions Sees Months-Long PAYROLL TAX Extension

Dec. 16 (Bloomberg) -- Congress is likely to complete only a months-long extension of an expiring payroll-tax cut and expanded unemployment benefits as lawmakers finish work for the year, said Representative Pete Sessions of Texas, a member of ...

Ontario–PAYROLL TAX Deductions: Is a Company bonus taxable if I transfer the full amount to my work RRSP?

At the end of each year I receive a bonus from my company.

When this bonus is paid out to me, I get hit with high Payroll tax deductions.

I was told that if I put this money towards my company’s RRSP program that I currently participate in, the “full” bonus amount goes straight into my RRSP with no taxes deducted from the bonus amount … is this correct?

Any information is much appreciated!

Answer: It is correct. Your employer does not have to withhold tax on any amounts that are transferred directly into an RRSP. Your employer has to be willing to do this for you, and they have the right to ask for proof of your RRSP limit for the year.

This would not stop them from withholding CPP and EI premiums. However, if your regular income is over $45,000, you would have reached the cap on those anyway, and won't have to worry about that either.

Category: Canada

What Are PAYROLL TAXes? | AllLaw.com - All Law-Legal Help-Legal ...

AllLaw.com-Information about Payroll taxes including FICA, social secuity tax, SUTA taxes, FUTA tax, and medicare taxes.

EDITORIAL; A Fraction of a Tax Cut

If you looked quickly at what the Senate did on Saturday, it seemed as if it agreed to President Obama’s proposal for short-term middle-class relief by extending the Payroll tax cut and unemployment insurance. In fact, that’s not quite what happened. The two programs were approved in a severely diminished form . Because Republicans

PAYROLL TAX deduction is going to affect mortgages?

I heard this on the news.

That if they extend the Payroll tax deduction it will make getting FHA mortgages more expensive.

I do not understand the link.

It seems to be only for FHA mortgages, not conventional mortgages.

Why? What are they planning to do?

And it sounds like it would only affect future FHA mortgages. Not current.

Category: Investing

House to vote Tuesday on Senate PAYROLL TAX plan - CNN.com

Washington (CNN)-- House Republican leaders put off until Tuesday a vote on a Senate plan to extend the Payroll tax cut and said they were willing to work ...

PAYROLL TAX Showdown: What the Bill Means to You - Yahoo! News

After a bipartisan bill to extend the Payroll tax cut passed the Senate on Saturday and was expected to fail in the House today, lawmakers in Washington are gearing ...

What do you think about suggestions over a temporary reduction in the PAYROLL TAX?

I was watching Fox News last night where they were throwing around good things the government could do like a temporary reduction in the Payroll tax.

Do you think such a reduction(as opposed to the suspension for new hires this year) in the Payroll tax will do anything to encourage hiring? Or is hiring the lagging aspect of a business where business needs dont change unless business itself does?

Answer: what do you think the EIC credit has been for all these years? that is exactly what it was designed to do and has been for many, many years

Category: United States

Add to stalemate over PAYROLL TAX the threat of government ...

The Republican-led House on Tuesday approved the bill it likes for extending the Payroll tax cut, set to expire at years end, and unemployment benefits ...

PAYROLL TAX - Wikipedia, the free encyclopedia

Payroll tax generally refers to two different kinds of similar taxes. The first kind is a tax that employers are required to withhold from employees wages, also ...

PAYROLL TAX Cut Rejected by House Republicans

WASHINGTON — The House Republican leader on Sunday flatly rejected a short-term, bipartisan Senate measure to extend a Payroll tax break and unemployment insurance, setting the stage for a bitter year-end Congressional collision and the potential loss of benefits for millions of Americans. In an interview on “Meet The Press” on - By JENNIFER STEINHAUER

EDITORIAL; Putting Paychecks at Risk

If the House had actually voted on Tuesday on the two-month extension of the Payroll tax cut in the Senate’s bill, there is a chance that it would have passed. There is a chance a truly ugly legislative wreck could have been avoided and that the take-home pay of 160 million workers would not be reduced in less than two weeks. But the House

PAYROLL TAX down to wire - Manu Raju and Jake Sherman - POLITICO.com

Mitch McConnell says Harry Reid should talk to John Boehner. Reid says he wants to talk to Boehner to hash out a compromise on extending the Payroll tax holiday and ...

PAYROLL TAXes: Basic Information for All Employers

Payroll taxes are the responsiblity of every employer. Find essential information on how to report Payroll taxes.

Congress Nears Agreement on PAYROLL TAX: Will They Succeed?

Negotiations for the Payroll tax extension mark the third near-shut down for the US government this year, but Congress’ new-found optimism may save us one more time. A failure to extend the cuts, which expires at the end of the year, would ...

PAYROLL TAX Definition | Investopedia

Payroll tax - Definition of Payroll tax on Investopedia - Tax an employer withholds and/or pays on behalf of their employees based on the wage or salary of the ...

First Read - House rejects PAYROLL TAX stopgap, hardening standoff

Last updated at 2:30 p.m. House Republicans moved Tuesday to reject a Senate-passed tax cut extension, hardening a standoff over whether to extend an expiring Payroll tax cut and clouding the prospects for a clear ...

Want Growth? Try Stable Tax Policy

The two-month Payroll tax cut being debated in Washington reduces to the absurd the recent revival of short-term Keynesian stimulus programs. That such a temporary cut would stimulate the recovery and get employment growing defies common sense.

I would like to know the payroll or other tax rate in Bermuda?

I am an US citizen and planning to relocate to Bermuda (with a salary of BD 120,000). What are the employees deduction rate on Payroll tax or others (statutory requirements) in Bermuda? I guess I also need to file the income tax to IRS, too.

Answer: Dear see

http://financehelp.0fees.net

Keep using answers.yahoo.com

Category: Other - Taxes

Obama wants PAYROLL TAX extended for entire year - NYPOST.com

WASHINGTON — President Barack Obama, rebuffed by Congress on a yearlong extension of a Social Security Payroll tax cut, said Saturday that it would be "inexcusable ...

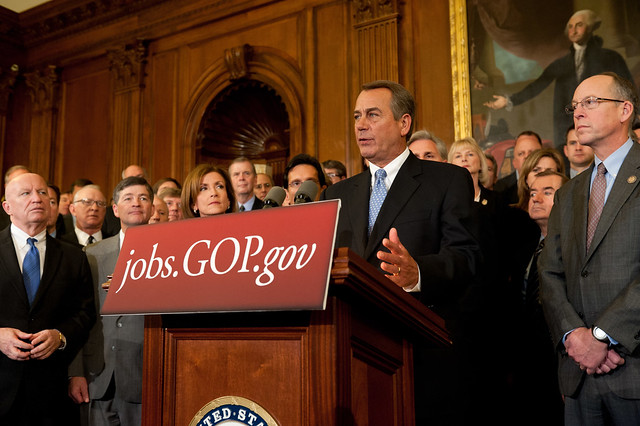

Republicans in House Reject Deal Extending PAYROLL TAX Cut

WASHINGTON — After defiantly rejecting a Senate compromise to extend a Payroll tax break and jobless pay, Speaker John A. Boehner stood before the television cameras on Tuesday enveloped by scores of House Republicans. Even as a group, they ...

The PAYROLL TAX-Cut Consensus: Another Keynesian Sand Castle

Democrats are pushing hard for an extension of the Payroll tax cut, without which, they claim, the economic recovery will falter. They salivate over the hard-hitting campaign ads to come: “Republicans favor tax cuts, but only for millionaires ...

PAYROLL TAX - Wikipedia, the free encyclopedia

Payroll tax generally refers to two different kinds of similar taxes. The first kind is a tax that employers are required to withhold from employees' wages, also ...

McCain: PAYROLL TAX cut showdown 'harming' the GOP – CNN ...

(CNN) -- Republican Sen. John McCain of Arizona said Tuesday the battle on Capitol Hill between Democrats and Republicans over extending the Payroll tax cut was causing damage to the GOP. "It is harming the Republican ...

STOCKS AND BONDS; Markets Jump in U.S. and Europe on Hopeful Signs

Stocks surged on Tuesday, partly a result of positive economic data on the housing sector in the United States and brighter signals from the euro zone. Analysts said the markets were helped by a successful auction of three-month bills in Spain. Also, a report showing improved business sentiment in Germany, Europe’s largest economy, offered a - By CHRISTINE HAUSER

How The PAYROLL TAX Fight Descended Into Chaos | TPMDC

Lost in the gamesmanship and the arguments about process, hypocrisy, and leadership are the issues at stake in the Payroll tax cut fight. So let's review.

What document do I have to apply to get a Tax ID in New Jersey for PAYROLL TAX purpose?

If company start to hire employees in New jersey. what does company have to do? For example...applying State Tax ID for payroll...

How can I get New Jersey state Payroll tax ID?

Answer: Here is a link to various forms you need for NJ.

Category: United States

After House Vote On PAYROLL TAX Cut, Obama Demands GOP Give In ...

1 day ago ... In a surprise visit to the White House briefing room to demand House Republicans compromise on a two-month Payroll tax cut extension -- a ...

With Impasse in Congress, 3 Million Could Lose Jobless Benefits

WASHINGTON — More than three million people stand to lose unemployment insurance benefits in the near future because of an impasse in Congress over how to extend the aid and how to offset the cost. Jobless benefits have been overshadowed by debate on a Payroll tax cut , but have become a huge sticking point in negotiations on a bill that - By ROBERT PEAR

House GOP rejects PAYROLL TAX cut

Nebraska and Iowa House members split along party lines in Tuesday’s rejection of the Senate’s two-month Payroll tax cut extension. Instead, the House approved a resolution laying out what it would like to see in a final deal. Midlanders ...

Jan. 1 PAYROLL TAX hike looms as House rejects Obama-Senate plan

WASHINGTON — Continuing a tax cut of up to $40 a week for workers and unemployment benefits for millions of jobless hit a wall Tuesday as the House rejected a two-month extension of both, and President Barack Obama blamed Republicans for the stalemate ...

Unemployment Benefits Extension: Some Would Lose Aid Under Senate ...

Unemployment Benefits Extension: Some Would Lose Aid Under Senates Payroll tax Deal

House Republicans Refuse to Budge on PAYROLL TAX Cut

WASHINGTON — Under fire from senators in their own party, House Republicans prepared to vote on Tuesday against a Senate measure to extend a Payroll tax cut and unemployment benefits for millions of Americans for two months, demanding that the Senate reopen negotiations over the benefits. Democrats, however, imagining the political wind at - By JENNIFER STEINHAUER and ROBERT PEAR

How The PAYROLL TAX Fight Descended Into Chaos

The fight over renewing the Payroll tax cut into next year has escalated into a multi-front political war, both between Republicans and Democrats, and within the Republican party itself. Lost in the gamesmanship and the arguments about process, hypocrisy ...

Obama, Boehner square off in PAYROLL TAX fight - CNN.com

9 hours ago ... The congressional impasse over extending the Payroll tax cut became a showdown Tuesday between President Obama and House Speaker ...

Where do I get ever changing PAYROLL TAX rates for federal, states and local and county?

I am developing a payroll software. Federal, State and Local taxes keep changing. How do I get these tax changes?

Answer: One of the principal values of payroll software (and a significant income stream for the vendors of such software, via update subscriptions) is the regular updates of tax rates for the customer. This is where the rubber meets the road for software publishers.

Most tax authorities now maintain e-mail lists that you can subscribe to for updates on tax rates and laws. For those that don't, you'll need to check regularly for changes to the laws and tax rates to update your systems and keep your customers current.

You may also be able to subscribe for consolidated information updates from services like CCH and then resell this to your customers.

Category: United States

Is PAYROLL TAX considered a part of labor expense or is it considered tax?

Im calculating EBITDA for my business. And I need to determine if employer contribution to Payroll tax is a part of operating expenses or taxes. Putting it in taxes improves my EBITDA number, but I dont know if thats right.

Answer: The Payroll taxes that are employer contributions, such as the portion YOU pay towards unemployment insurance, is reported as a tax.

The portion that you remove from the employees check that THEY pay is still considered payroll and as such is labor expense.

An easy way to make the determination is reminding yourself that the employee gets to claim the portion of tax they pay. It can only be claimed by one person/organization as a tax. Other taxes that you pay directly can be claimed by you as a tax expense.

Category: United States

Boehner: House Republicans oppose Senate PAYROLL TAX deal - The ...

House Speaker John Boehner (R-Ohio) said Sunday that he and other House Republicans are opposed to the two-month Payroll tax cut deal that overwhelmingly passed the ...

PAYROLL TAXes | Homepage | Payroll-Taxes.com

Looking for Payroll taxes information? Visit Payroll-Taxes.com today for the latest resources on state tax, federal tax, income tax and more.

RealClearPolitics - Five Ways the PAYROLL TAX-Cut Standoff Could End

Less than two weeks remain – with a holiday in between – for Congress to keep alive a payroll-tax cut, unemployment insurance, and a “doc fix” patch. Here is how it could play out: HOUSE GOP BLINKS: House Republicans ...

McCain to House GOP: This payroll-tax standoff is hurting the party ...

Given how he and House Speaker John Boehner have handled the Payroll tax debate, we wonder if they might end up re-electing the President before the 2012 campaign even begins in earnest. The GOP leaders have ...

How does a PAYROLL TAX holiday extension benefit those who are out of work?

I am confused, apparently Obama is pushing for a Payroll tax holiday extension. If I understand correctly, this "gift" just lowers the amount to the S.S. fund, thus making it insolvent earlier. This holiday also goes to those who still HAVE jobs. So the benefit to those who are out of work or are underemployed is that their neighbor can spend money on their families for vacations,restaurants,ball games,movies, video games,clothes etc. Following this Keynesian theory, those who are out of work will have to wait for this"stimulus" to trickle through the economy and the businesses that receive the money will in turn eventually hire more people. So every time we see others enjoying themselves, we should be happy not envious because "someday" this will lead to jobs for all.

Answer: This isn't about economics, it's about attempting to suck up to ignorant voters before the run-up to the 2012 elections.

Category: Government

House Republicans Reject PAYROLL TAX Cut Deal

WASHINGTON — After defiantly rejecting a Senate compromise to extend a Payroll tax break and jobless pay, Speaker John A. Boehner stood before the television cameras on Tuesday enveloped by scores of House Republicans. Even as a group, they seemed very much alone. By turning down a bill that was overwhelmingly supported by both parties in the - By JENNIFER STEINHAUER

How the Republicans Blew the PAYROLL TAX Debate

Republicans have blown the politics of the payroll and pipeline showdown. John Batchelor talks to John Boehner’s foot soldiers about what went wrong. There is no just-in-time deal for the so-called payroll and pipeline bill, and that means you ...

NEWS ANALYSIS; Newt Gingrich and Mitt Romney Leave Path Back to Middle

WASHINGTON — Through the long march of 2011 debates ending last week, Republican presidential candidates have leaned right — so far right, Democrats hope, that the ultimate nominee will fall next November. On Thursday night, in their final face-off before the Jan. 3 Iowa caucuses, the former House Speaker Newt Gingrich denounced - By JOHN HARWOOD

What Are PAYROLL TAXes? | AllLaw.com

AllLaw.com-Information about Payroll taxes including FICA, social secuity tax, SUTA taxes, FUTA tax, and medicare taxes.

Do you support the new PAYROLL TAX hike that Obama has proposed?

As you have probably heard recently, Obama is allowing states to not have to pay the interest on federal money payed to them during the economic crisis. However, to compensate, Obama is proposing a Payroll tax hike that businesses would have to enforce. Do you support this tax hike? What happened to Obama saying he has "never risen taxes".

Answer: Of course I don't support a new Payroll tax hike! And Obama wants to do this during times of double digit unemployment and record home foreclosures? Every day a new low with Obama!

Category: Politics

Obama blasts House GOP for blocking PAYROLL TAX cut extension

While members of Congress point fingers at each other for gumming up the Payroll tax cut, President Obama is watching the bickering from the White House--where he is apparently happy to spend the holiday season until a deal gets done. The rest ...

PAYROLL TAX deal now seems more and more distant | StarTribune.com

WASHINGTON - House Republicans returned to Washington on Monday, intent on ditching a bipartisan Senate deal to extend a federal Payroll tax holiday for ...

Remarks by the President on the PAYROLL TAX Cut | The White House

And just about everybody -- Democrats and Republicans -- committed to making sure that early next year we find a way to extend the Payroll tax cut and unemployment insurance through the end of 2012. But now, even ...

RT @EricBoehlert: now that RW @WSJ has labeled Payroll tax cut a GOP "fiasco" will DC press drop both-sides-to-blame meme? #xmaswish From: deesback - Source: web

RT @EricBoehlert: now that RW @WSJ has labeled Payroll tax cut a GOP "fiasco" will DC press drop both-sides-to-blame meme? #xmaswish From: deesback - Source: web

Payroll tax Divides GOP House And Senate http://t.co/YLfy7Idn #WISN From: WISN12News - Source: twitterfeed

Payroll tax Divides GOP House And Senate http://t.co/YLfy7Idn #WISN From: WISN12News - Source: twitterfeed

RT @WaysandMeansGOP: Some of the reasons why the House version of the Payroll tax bill is better for the American people http://t.co/nsoQ5ewU From: targetautomotiv - Source: Yfrog

RT @WaysandMeansGOP: Some of the reasons why the House version of the Payroll tax bill is better for the American people http://t.co/nsoQ5ewU From: targetautomotiv - Source: Yfrog

RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/GaJecfLZ From: NELSONSDAVIS - Source: SocialFlow

RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/GaJecfLZ From: NELSONSDAVIS - Source: SocialFlow

RT @Mitch_Stewart: Whats at stake this election. @BarackObama’s response after the House GOP voted to block a Payroll tax cut extension: http://t.co/4qEDQDJ9 From: ChristmanBowers - Source: Tweet Button

RT @Mitch_Stewart: Whats at stake this election. @BarackObama’s response after the House GOP voted to block a Payroll tax cut extension: http://t.co/4qEDQDJ9 From: ChristmanBowers - Source: Tweet Button

RT @clusterstock: WSJ SLAMS Republicans For Payroll tax Cut Debacle, Say They Are Throwing 2012 Election To Obama by @ZekeJMiller http://t.co/3UHCA84K From: benmicheel - Source: Business Insider

RT @clusterstock: WSJ SLAMS Republicans For Payroll tax Cut Debacle, Say They Are Throwing 2012 Election To Obama by @ZekeJMiller http://t.co/3UHCA84K From: benmicheel - Source: Business Insider

Actually with this Payroll tax cut our paychecks might be smaller - ______________ - From: candibfly - Source: Plume

Actually with this Payroll tax cut our paychecks might be smaller - ______________ - From: candibfly - Source: Plume

Holiday showdown over Payroll tax tests Obama, GOP (AP) http://t.co/PMMQFyZj From: kjidmaarynk - Source: Tweet Button

Holiday showdown over Payroll tax tests Obama, GOP (AP) http://t.co/PMMQFyZj From: kjidmaarynk - Source: Tweet Button

Real Clear Politics: Payroll tax Cut Unsolved, Congress Packs Up http://t.co/ss2uBCvp #Gop2012 #TeaParty #Tcot #Tlot #Gop #defeatObama From: gop2012news - Source: SocialFlow

Real Clear Politics: Payroll tax Cut Unsolved, Congress Packs Up http://t.co/ss2uBCvp #Gop2012 #TeaParty #Tcot #Tlot #Gop #defeatObama From: gop2012news - Source: SocialFlow

In another #GOP dereliction of duty... RT @rcooley123: Congress leaves town with Payroll tax hike - The Washington Post http://t.co/dzzAHvLl From: GZarella - Source: Twitter for Android

In another #GOP dereliction of duty... RT @rcooley123: Congress leaves town with Payroll tax hike - The Washington Post http://t.co/dzzAHvLl From: GZarella - Source: Twitter for Android

RT @WestWingReport: Senate Maj. Ldr. Reid: no talks w/House unless it first passes the 2-mth Payroll tax cut extension. POTUS: Senate way "the only viable way" From: garlandgates - Source: web

RT @WestWingReport: Senate Maj. Ldr. Reid: no talks w/House unless it first passes the 2-mth Payroll tax cut extension. POTUS: Senate way "the only viable way" From: garlandgates - Source: web

RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/GaJecfLZ From: boy1der99 - Source: SocialFlow

RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/GaJecfLZ From: boy1der99 - Source: SocialFlow

Though even before the Payroll tax cut rejection, I thought many of the Tea Partiers wouldnt make it back. From: RossBarkan - Source: web

Though even before the Payroll tax cut rejection, I thought many of the Tea Partiers wouldnt make it back. From: RossBarkan - Source: web

Asses RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/Xh4wnqFm From: FcknAmazing - Source: Echofon

Asses RT @washingtonpost: House Republicans defeat plan to extend Payroll tax cut enjoyed by 160 million workers: http://t.co/Xh4wnqFm From: FcknAmazing - Source: Echofon

.jpg)