Apple dividend : Photo Gallery

Apple dividend : Videos

Apple dividend : Latest News, Information, Answers and Websites

Apple Investors Divided on Dividends - TheStreet

A famous dividend non-payer, chatter about a possible dividend has swirled around Apple in recent months, and Cook has already hinted that he may rethink ...

Will Apple Announce "The Dividend" Tomorrow? | ZeroHedge

5 minutes ago ... Minutes ago Apple announced that first thing tomorrow it will "host a conference call to announce the outcome of the Company's discussions ...

Apple Announces Plans to Initiate Dividend and Share Repurchase ...

Apple has issued a press released indicating that it plans to initiate a dividend and share repurchase program commencing later this year. Subject to...

APPLE DIVIDEND Seen Returning Part of $98 Billion in Cash

Apple Inc., approaching a $500 billion market capitalization, will probably start paying a dividend this year, attempting to appease investors who have said the ...

Dividend impact on Call Options?

Hi, Hope someone can share some insight on my dilemma. I have several Call Options for Apple which expires in Jan 2012. Apple has lots of cash and rumors are Apple is going to pay a one time dividend to investors. How is it going to impact my call options?

Answer: Most of the time, option prices are not adjusted to reflect dividends. (Sometimes they are adjusted for unusually large dividends.) Since dividends do affect stock prices, but options are not adjusted, this can change the value of your options by quite a bit.

From the time the dividend is declared until the ex-dividend date, the stock is likely to inch up in the market to reflect that owners prior to the ex-dividend date will be entitled to the dividend. This will increase the intrinsic value of calls On the ex-dividend date, the stock will fall in value to reflect the fact that new buyers of the stock will no longer be entitled to the dividend. At this point, call options will fall in intrinsic value.

If the Apple dividend isn't large enough to be considered for adjustment (which it probably won't be) you should sell them before the ex-dividend date. I would sell them the day they declare the dividend. On the ex-dividend date you'll probably be able to buy them back at a lower price.

Category: Investing

Apple to Use Cash for Stock Dividend and Buyback - NYTimes.com

5 hours ago ... The technology company said it would use some of its $100 billion in cash reserves to pay a quarterly dividend of $2.65 a share beginning this ...

Apple Investors Await a Dividend Gusher - Bloomberg

Apple Inc. (AAPL) has Wall Street’s full attention after hinting at plans for the company’s $100 billion cash pile that may lead to stockholders ...

Apple Seen Paying Some of $97.6 Billion in Cash as Dividend

Apple Inc. (AAPL), which plans to discuss its $97.6 billion in cash and investments in a conference call today, is likely to announce a dividend, according to analysts’ predictions and data compiled by Bloomberg. Chief Executive Officer Tim ...

Small-Cap Stocks Surge Ahead of the Big Names

In a Wall Street universe populated by marquee name stocks, the lesser known entities are the stars of the rally so far this year. The Russell 2000 index, which tracks stocks with a small market capitalization, is nearing its record high with a rise of about 11 percent in the year to date. That outstrips the Russell 1000 index that measures Wall - Surge in so-called small-cap stocks, or companies whose total share value is $3 billion or less, indicates that investor appetite for risk and confidence in the economy is growing; lesser known entities have been the surprise stars of a 2012 stock rally in a Wall Street universe populated by marquee name stocks. Photo, Graph (M)/ - By CHRISTINE HAUSER

Apple to Use Cash for Stock Dividend and Buyback

SAN FRANCISCO — Apple announced Monday that it would pay a quarterly stock dividend of $2.65 a share beginning in the quarter that starts in July, and its board authorized a $10 billion share buyback. The moves will reward investors by using up some of the company’s cash hoard of nearly $100 billion and likely attract a new group of - By NICK WINGFIELD

When is Apple due next to give dividends?

Does Apple give dividends?

Answer: http://finance.yahoo.com/q/hp?s=AAPL&a=08&b=7&c=1984&d=08&e=6&f=2007&g=v

I guess not since 1995

Category: Investing

REUTERS BREAKINGVIEWS; Finding Optimism In a Longer View

It is the oldest saw in investing: buy low and sell high. But with shares at their cheapest in a generation, confident equity investors are a rare breed. In 1999, share buyers were eager for any old variety of equity and plenty of the new-fangled dot-coms. Even a sober investor, one who bought a diversified basket of stocks from the Standard & - Reuters BreakingViews column opines savers confident enough to believe better times will return within a few years should hope the gloom lasts a bit longer, because it is a great time to buy equities; notes risks in hot and fast-growing markets of cloud computing and cybersecurity. Photo (M) - By ROBERT COLE and RICHARD BEALES

Bottom Line - Stocks edge up after Apple begins dividend

U.S. stocks edged higher Monday, hovering near 4-year highs, as shares of Apple rose after it said it will begin paying a dividend and buy back stock. Apple Inc, which accounts for about 19 percent of the Nasdaq 100, was up ...

Can I invest in a company such that the ROI/dividend is the companys latest product?

for example: I might invest a certain(small) amount in say Apple Inc. And I might choose to get the latest product instead of cash.

Answer: Or.... take the dividend and use it to BUY the latest product.

Category: Investing

APPLE DIVIDEND More Likely Than $100 Billion Toga Party - John ...

Will Apple ever return some of its growing cash pile to investors? Can shareholders expect a dividend, now that the company has amassed nearly $100 billion in cash ...

Why buy Apple stock if they pay out 0 dividends?

What makes Apple stock so appealing other than the fact that their stock prices are increasing? Many individuals make millions per year off of dividends that are paid out, including Steve Jobs himself (makes money from Disneys dividends).

ALSO: Why doesnt Apple pay dividends to stockholders?

Answer: The dividend is just icing on the cake, not the reason you invest in stocks.

To answer, turn the question around a little bit.

Why buy a stock for a paltry 1% dividend and take the risk of losing half your money in a gyrating stock market.

Category: Investing

STOCKS AND BONDS; Shares End Fairly Flat as S.&P. 500 Breaks Its Streak

The Standard & Poor’s 500-stock index ended lower Wednesday, breaking a five-day streak of gains, as investors found little reason to extend a rally that took the benchmark index to four-year highs. Attention turned to the bond market, where the Treasury’s benchmark 10-year note fell more than a percentage point, sending the - By REUTERS

Politically speaking; will apple stock sink just as soon as they announce how theyre doling out the treasure?

Steve Jobs built Apple, but didnt believe in dividends. Now dead, investors expect someone more PLIABLE to do their bidding. Namely, stop growing the company and loot it on their behalf.

With all of that loot on hand, wont apple stock fall after the investor class sucks up all of the sugar water?

Category: Politics

Apple to Say Monday How It Will Use Cash Hoard

Apple has finally decided what to do with its cash hoard of nearly $100 billion. The company issued an unusual media alert on Sunday evening saying it planned to announce on Monday morning the long-awaited outcome to a discussion by its board about what to do with its cash balance. It will announce its plans in a conference call at 9 a.m. Eastern - By NICK WINGFIELD

Apple: Deutsche Calls Dividend ‘Expected Positive’

Last week Deutsche Bank dared to doubt the steepness of the meteoric rise in Apple shares. Today, the firm describes this morning’s dividend and share buyback plan as “an expected positive.” “The dividend announcement was in-line with ...

What is your guess on Apple cash decision today?

At 9am today they are going to say what they are doing with the 98B.

My guess is a one time large dividend payout, it doesnt really make sense to announce a regular div until growth has stopped or slowed greatly. They arent really a company that buys other large companies and wouldnt make sense to do that. What is your guess?

Category: Investing

Does anyone know about the Apple Reit through David Lerner does it really pay an 8% monthly Dividend?

Does anyone invest in this Company?

Answer: Here is the company's website: http://www.applereitcompanies.com/investorinfo.htm

A REIT is an investment that is considered very risky, because although it does usually pay a significant dividend (which can change without notice), it is completely illiquid. You may have to wait years to get your investment back, and you are not guaranteed to even get it back if times get tough.

REITs are usually sold to accredited investors (net worth of at least $250,000 or income of at least $70,000 per year). REITs are generally used for income by people with high net worths, who can afford to lose or live without for some time usually no more than 10% of their assets.

Category: Personal Finance

APPLE DIVIDEND and Its Offshore Cash - Deal Journal - WSJ

Bernstein Research today focuses on the question of an Apple dividend. Specifically, it examines how Apple’s large offshore cash pile would impact a ...

Apple is dividend funds’ new darling

At first bite, Apple’s /quotes/zigman/68270 /quotes/nls/aapl AAPL 1.4% dividend yield seems a bit mealy, being below the Standard & Poor’s 500 Index /quotes/zigman/3870025 SPX average . But any payout would be enough to attract mutual ...

Apple's dividend and buyback: What the analysts are saying - Apple ...

Apple (AAPL) gave Wall Street what it had been asking for The Street's reaction has been largely positive, and the stock hit a new record intraday high of $606 in early afternoon trading. Jefferies' Peter Misek: Dividend and ...

APPLE DIVIDENDs - Indews Broadcast

Apple, Inc. Dividend Policy. I previously wrote an article on why some companies like Apple Computer Inc do not pay their shareholders Cash Dividends anymore.

Apple not cutting prices, but paying dividend, buying stock

NEW YORK — Apple is finally acknowledging that it has more money than it needs. But don’t expect it to cut prices on iPhones and iPads. Instead, the company said on Monday that it will reward its shareholders with a dividend and a share ...

WEALTH MATTERS; When Safe Bonds Dont Yield Enough to Retire On

PLAYING safe with your investments doesnt pay these days. United States Treasury bonds and other high-grade bonds used to be the safe way for older investors to generate income in their portfolios. But yields on these bonds are now so low, they are not generating much income. The Federal Reserves announcement on Wednesday that short-term interest - Paul Sullivan Wealth Matters column observes that treasuries and other highly rated bonds were once a safe way for older investors to generate income, but todays low bond yields call for a new strategy; discusses three income-generating scenarios for investors nearing or in retirement. Photo (M) - By PAUL SULLIVAN

Does Apple give a dividend?

the stock

Answer: Apple's 2nd-quarter profit jumps 88 percent; stock hits new high

SAN JOSE, Calif.- Shares of Apple Inc. soared above $100 for the first time after the company walloped Wall Street expectations with quarterly profits that jumped 88 percent on strong sales of its iPod players and Macintosh computers.

The shares gained more than 7 percent on the news in after-hours trading Wednesday.

Investor optimism in the trendsetting company may have also been bolstered by a vote of confidence the board of directors gave Apple's chief executive officer, Steve Jobs. The board on Wednesday defended the iconic CEO from new accusations by a former Apple executive who alleged Jobs may have had a more significant role in the company's backdating of stock options than previously stated.

For the first three months of the year, the Cupertino-based company said it earned $770 million, or 87 cents per share, up from $410 million, or 47 cents per share, in the year-ago period.

Sales were $5.26 billion, up 21 percent from $4.36 billion last year.

Analysts, on average, were looking for earnings of 64 cents per share on sales of $5.17 billion, according to a poll by Thomson Financial.

Shares of Apple closed at $95.35, up $2.11, or about 2 percent, on the Nasdaq Stock Market, then leaped to $102.40 in after-hours trading.

At Wednesday's closing price, the shares have gained about 11 percent this year, boosted partly by anticipation over the iPhone. Investors have largely remain unfazed by Apple's stock options troubles, with industry analysts widely predicting Jobs' position at Apple will remain intact.

But legal experts say Jobs is still in legal limbo: An investigation by federal prosecutors continues and the accusations thrown Tuesday by the company's former chief financial officer, Fred Anderson, raises questions about Jobs' culpability.

Anderson's allegations came on the same day he immediately settled his case with the Securities and Exchange Commission, which filed backdating-related civil charges against Anderson and Apple's former general counsel Nancy Heinen. The SEC did not charge any other individuals and said it did not plan to pursue further action against Apple itself.

Apple's board of directors, which includes former Vice President Al Gore and Google Inc. CEO Eric Schmidt, said Wednesday that it would not enter a public debate with Anderson. It also defended Apple's internal probe last year that cleared Jobs and current management of any wrongdoing.

"We have complete confidence in the conclusions of Apple's independent investigation, and in Steve's integrity and his ability to lead Apple," the board said in a statement.

Category: Investing

Apple: Street Cheers Dividend, Buybacks

Responses from the Street are flowing in regarding Apple‘s (AAPL) announcement this morning it will offer a $2.65 per share dividend per quarter, and initiate $10 billion of stock buybacks starting in the December-ending fiscal first quarter.

An APPLE DIVIDEND in 2012? Keep praying- MSN Money

Apple investors should be some of the happiest shareholders on Wall Street. And for the most part, they are. But when it comes to the question of dividends ...

An APPLE DIVIDEND in 2012 Is Unlikely | InvestorPlace

An Apple dividend in 2012? Keep Praying Here’s why shareholders still are unlikely to get any of Apples ever-mounting cash hoard

Apple rewards investors with dividend, share buyback | Reuters

49 minutes ago ... SAN FRANCISCO (Reuters) - Apple Inc CEO Tim Cook, moving swiftly after taking over from the late Silicon Valley icon Steve Jobs, fulfilled a ...

About Dividend Yields?

Im doing a stock project on Apple inc. I am having a hard time understanding Dividends- I know that Apple dosent pay dividends, does that mean it dosent have a dividend yield? Im not sure what that means. I know there is a way to figure out a dividend yield, but I really cant figure the concept out. Thank you for any help, I really appreciate your time.

Answer: If they don't pay dividends, the answer is $0 or N/A.

Investors will make their money when they sell at a gain (they hope).

Category: Investing

Apple A Ripe Dividend-Growth Target, Analyst Says

Apple’s (AAPL) immediately the second biggest dividend payer in the Standard & Poor’s 500-stock index (SPX), with its new payout well outstripping the previous king of dividend initiations, by Cisco (CSCO). But there are already complaints ...

Bottom Line - Apple to begin paying quarterly dividend of $2.65 a ...

Apple, sitting on a cash hoard of nearly $100 billion, said Monday it will begin paying a quarterly dividend of $2.65 a share this year and spend another $10 billion on a stock repurchase program. Wall Street investors and ...

Apple Will Issue Dividends, Kick Off $10 Billion Share Repurchase ...

Apple's sitting on a considerable pile of cash, and they've even scheduled an early morning call to discuss what they plan to do with it. Well, that wait is over — a release from the Cupertino company just hit the wires stating ...

Why should I keep stock with no dividend?

Does long term (3-10 years) investment correct? What reason I should keep the stocks which dont give dividends (such as Google, Apple...)? I have few stocks in my IRA account, and I just realize there is no point to keep those no dividend stocks for long term, because what I get is only capital gain or loss. Am I right?

Answer: Well, stocks that don't pay dividends are called "growth" stocks and you keep them because, supposedly, you reap your benefit from them when you sell them, because during the period that you held them they grew in value.

Of course, that was true a while ago, during the boom economy. Now that we're in a bust economy a lot of people, myself included, are selling off their "growth" stocks whenever they can do so without taking a loss on them, and then putting that money into "income" stocks and mutual funds that pay out regular dividends.

Good luck, and the link below is to a webpage about "Growth vs. Income"...

Category: Investing

Apple has a reported $46 billion in cash?

Should they offer shareholders buy back of Apple shares, dividends or preserve capital? Apple traditionally does not pay dividends. If they hold on to the cash and do not pay shareholders they could be sitting at $65 billion at the end of 2011. I say keep it, for the foreseeable future for the good of the company and the shareholders. Their is just one Steve Jobs.

Please read link below.

http://blogs.wsj.com/digits/2010/08/12/wall-street-analyst-wants-apple-to-return-cash-to-investors/

Answer: For reasons that are not obvious to casual investors, certain companies absolutely hate to pay dividends. They had rather hoard their cash or buy back their overvalued stocks. If however you are a Steven Jobs or Bill Gates such a strategy make perfect sense. They own so much stock that any dividend would mean that they would have to pay taxes on the amount. Taxes you and I could only dream about paying. They hate to do so and they do have a very strong voice in the running of the company. So instead the company sits on the cash or wastes it buying back stock or buying some other company for 5x what it is probably worth. Intel just paid a kings ransom for McAfee. Intel though does pay a decent dividend, but the company is stuck in neutral. Not good for a techy company.

Category: Investing

APPLE DIVIDEND: What the analysts say

Apple Inc said on Monday it plans to pay a quarterly dividend of US$2.65 per share and authorized a US$10 billion stock buyback program to be executed over three years. The iPad, iPhone, iPod and Mac personal computer maker plans to initiate the ...

U.S. Stocks Gain as Apple Rallies While Treasuries Slump

U.S. stocks rose as Apple (AAPL) Inc. announced a dividend and buyback plan and banks advanced, while 10-year Treasuries extended the longest slump since 2006 as investors bet the economy will continue to strengthen. Natural gas and cotton led ...

Bottom Line - Stocks struggle after Apple starts dividend

U.S. stocks were struggling Monday, pulling back from nearly 4-year highs after cash-rich Apple said it will begin paying a dividend and buying back stock. Apple Inc, the world's most valuable company, announced it will ...

Apple Sets First Dividend In 17 Years, $10 Bln Share Buy-back

(RTTNews) - Putting to rest all speculation on what it will do with its enormous war chest, Apple, Inc. (AAPL: News ) finally announced plans Monday to again start paying quarterly dividends, and also set a $10 billion share repurchase program. Investors ...

Nasdaq Finishes Above 3,000, Its Best Since Dot-Com Bubble

Stocks rose to new heights on Tuesday, in part on stronger retail sales data, pushing the broad market to levels last seen in June 2008 and the Nasdaq composite index to close above 3,000 for the first time since 2000. On its joy ride heading into 2000, the technology-heavy Nasdaq reached its pinnacle of 5,048.62 on March 10 that year. Then the - By CHRISTINE HAUSER

Apple Cashpile Makes Dividend, Buyback ‘More Likely’ Morgan ...

Apple Inc., the world’s most valuable company, is “more likely than ever” to return money to shareholders in the form of a stock buyback or dividend ...

Apple announces dividend and share repurchase program for 2012 ...

6 hours ago ... Surprise, surprise -- Apple just let the cat out of it's own bag. In right around a half -hour, the company will officially unwrap plans to initiate a.

why does APPLE not pay cash dividends?

Why does APPLE not pay cash dividends?

What is the point of buying its stocks if it is not paying cash dividends?

Answer: Apple has a choice of paying out dividends or retaining the earnings. If they retain the earnings, the idea is that they will invest that money back into the company to increase the future value of the company. In theory, this will increase the shareholder's value by increasing the price of the stock, so that the shareholder can sell it for more than he paid for it, and make money that way.

Category: Other - Business & Finance

Stocks flat; Apple up on dividend announcement

NEW YORK (AP) — U.S. stocks struggled Monday to extend the rally from their best week of the year. Last week, the Dow and S&P 500 rose 2.4 percent apiece, their best showing of the year. For the first time, the Dow closed above 13,000 and the ...

Where to find the number of shares in a corporation?

I need to find the number of shares for AAPL (apple). Where can I find it? And how can I figure out the dividend and % return?

Answer: Yahoo Finance page has basic financial info and Dividend Yield

annual reports will have shares - maybe Apple's website in Investor Relations section

Category: Corporations

Apple to Pay Dividend, Buy Back Stock to Return Some of Cash ...

5 hours ago ... Apple Inc. will pay its first dividend in 17 years and buy back $10 billion in stock, heeding investors who urged it to return part of the $97.6 ...

SPECIAL SECTION: WEALTH; An Alternative That Avoids Overpriced Stocks

DO most index funds tilt the wrong way at the wrong time? If they are capitalization-weighted, as the majority of index funds are, thats often the case. While index funds are generally broad-basket, low-cost ways to invest passively in a variety of securities, a more fundamental approach might help you avoid the manias and sell-offs in a volatile - Research Affiliates Fundamental Indexing, known as RAFI, can help investors avoid the turmoil in unpredictable markets; strategy employs a composite measure of a companys sales, cash flow, book value and dividend, eliminating risk of overvalued stocks that are prone to fall hard when broad sentiment among investors sours; RAFI style avoids stocks when they are overpriced and finds companies with solid financial standing, eliminating market emotions in an attempt to buy low and sell high. Drawing (M) - By JOHN F. WASIK

6 Reasons Why You Shouldnt Reinvest Your APPLE DIVIDENDs

An Apple dividend Could Lure Warren Buffett Into The Stock Matt Schifrin Forbes Staff Take Berkshire’s ownership in Coca Cola (KO). If you go back 15 years to 1997 you will find that Berkshire owns the same number of KO shares then as it does ...

Canaccord Color on the APPLE DIVIDEND

Following Apple’s (AAPL) announcement of an initiation of a quarterly dividend, Canaccord Genuity technology analyst Michael Walkley reiterated his BUY rating and $710 price target, noting that AAPL remains a top pick. Mr. Walkley said: “We ...

If a stock doesnt have an annual dividend, does that make you make $0 on the stock?

Sony Corp and St. Jude Medical dont have an Annual Dividend for a rate. Our professor assigned us a project to make a portfolio, and he also gave us a sample portfolio (invest 100k to 5 stocks 1 bond in a 1/4 year)

. And in his sample, he chose Apple Inc, which pays NO Annual Dividend, but I chose 2... I calculated the capital gains, but am now confused with whether or not i should ignore SONY & ST JUDE when adding up my earnings since they dont have annual dividends.

Answer: Most people would value a portfolio's success by

its percentage increase as measured by the market share prices of the constituents. They may even ignore dividends altogether. Of course, dividends should be included in the measurement of perfromance and maybe you can even compare it to a benchmark.

Category: Investing

Why is it liberals never say anything bad about Apple computers? They outsource jobs to China & have $76 bill?

in cash.

Why are liberals so kind to them yet so obnoxious to other companies that outsource less & that have less cash?

http://www.forbes.com/sites/briancaulfield/2011/09/13/analyst-apple-should-spend-humongous-cash-hoard-on-dividend-or-stock-buyback/?feed=rss_home

Category: Politics

APPLE DIVIDEND Seen Returning Part of $98 Billion in Cash: Tech ...

Feb. 29 (Bloomberg) -- Apple Inc., which today topped a $500 billion market capitalization, will probably start paying a dividend this year, attempting to ...

Apple: Dividend Time? - Forbes

One of Wall Street’s few pet peeves when it comes to Apple is the company’s enormous, Everest-like mountain of cash. The company had $81 billion at the ...

Apple Seen Returning Some of $97.6 Billion in Cash With Dividend

March 19 (Bloomberg) -- Apple Inc., which plans to discuss its $97.6 billion in cash and investments in a conference call today, is likely to announce a dividend, according to analysts predictions and data compiled by Bloomberg. Chief Executive ...

Cash-rich Apple may pay dividend this year

Apple, which surpassed a $500 billion market capitalization Wednesday, will probably start paying a dividend this year, attempting to appease investors who ...

Apple - Press Info - Apple Announces Plans to Initiate Dividend and ...

CUPERTINO, California—March 19, 2012—Apple® today announced plans to initiate a dividend and share repurchase program commencing later this year.

Apple rewards investors with dividend, share buyback

SAN FRANCISCO (Reuters) - Apple Inc CEO Tim Cook, moving swiftly after taking over from the late Silicon Valley icon Steve Jobs, fulfilled a longstanding desire of investors by initiating a quarterly dividend and share buyback that will pay out ...

FUNDAMENTALLY; Its Small Consolation, but Big-Company Funds Fared Better

SINCE the start of the financial crisis, many money managers have been predicting that investors would gravitate to shares of large, industry-leading companies. Yet since the start of 2008, large-capitalization stocks have lagged riskier small-company shares, belying their reputation as ports in an economic storm. That changed a bit in the third - Paul J. Lim is a senior editor at Money magazine. - By PAUL J. LIM

Apple announces first dividend since 1995 - Mar. 19, 2012

5 hours ago ... Apple will give investors a dividend of $2.65 and buy back $10 billion in shares over three years.

Why would you recommend people to buy Apple products?

Give me 5 reasons to why you would agree to is a BUY product.

Ex: Does the company give a Dividend? What is the P/E Ratio? Any recent news that is good/bad for business? What do the experts say?Any current trends? Anything coming up in the future that YOU feel will benefit/hurt the company?

Answer: I don't agree with Apple...it's a joke, I have the iPod 3rd Gen. & iTunes likes to mess with it, and freeze my iPod & stuff.

Category: Other - Electronics

An APPLE DIVIDEND Could Lure Warren Buffett Into The Stock - Forbes

Berkshire loves dividend stocks and there is a good chance Apple will soon pay a dividend.

Wall Street Indexes Mixed

Stocks were mixed Monday as last weeks rally, bolstered by healthy job data, appeared to lose some steam. On Wall Street in morning trading, the Dow Jones industrial average and the broader Standard & Poors 500-stock index hovered around where they opened. Even the Nasdaq composite indx, despite the announcement from Apple of a dividend and - By THE ASSOCIATED PRESS

Apple plans to initiate dividend and share repurchase program ...

A statement by Apple this morning has confirmed the company will start paying dividends to investors and buy back US $10 billion in shares starting this.

Apple Investors Vent on Dividends, but Whats Next? - TheStreet

Many commenters and tweeters on TheStreets blog of Apple s shareholder meeting were clamoring for a dividend announcement. "There will be some news today ...

Apple announces dividend and share repurchase program for 2012 ...

Surprise, surprise -- Apple just let the cat out of it's own bag. In right around a half-hour, the company will officially unwrap plans to initiate a.

Tuesday Apple Rumors -- APPLE DIVIDEND Under Cook? | InvestorPlace

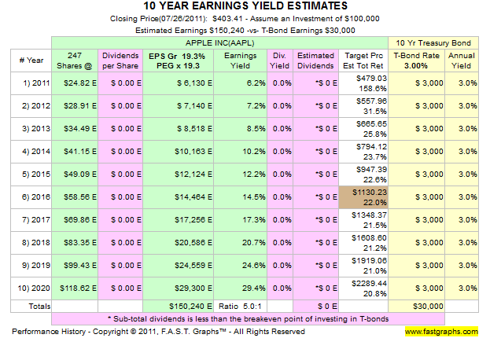

Report: Analyst thinks Tim Cook might finally steer Apple (AAPL) toward paying out a quarterly dividend, with the company being able to afford a 2.5% yield.

Apple Paying a Dividend? 7 Profitable High-Yield Companies (AAPL)

Could it be? Could Apple (Nasdaq: AAPL ) be announcing a "significant" dividend sometime soon? Money manager Howard Ward tells Bloomberg he suspects it may be issued ...

Apple decision on cash coming - will it announce dividend?

NEW YORK (AP) — Apple shares headed for another all-time high Monday ahead of an announcement about what the company plans to do with its enormous pile of cash. Apple said late Sunday that CEO Tim Cook would make an announcement before the market opens ...

Apple Inc. - Frequently Asked Questions

Apple does not currently pay dividends on its common stock. Apple paid dividends from June 15, 1987 to December 15, 1995. See Dividend History.

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/Dq5w5VKW From: ashriwastav - Source: twitterfeed

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/Dq5w5VKW From: ashriwastav - Source: twitterfeed

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/3dRsw438 From: stonevpartners - Source: twitterfeed

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/3dRsw438 From: stonevpartners - Source: twitterfeed

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/jU2QT15S From: vividspirit - Source: twitterfeed

Apples $10bn dividend payout may sound impressive …: But the implied yield of 1.77% is miserable and Apples ca... http://t.co/jU2QT15S From: vividspirit - Source: twitterfeed

Apple’s Dividend and Their Product Plans http://t.co/6arIrXG1 From: PandoTicker - Source: Pando Ticker

Apple’s Dividend and Their Product Plans http://t.co/6arIrXG1 From: PandoTicker - Source: Pando Ticker

Being abnormal got them where they are...why be normal???The day Apple became normal http://t.co/NEb3VjEN via @FortuneMagazine From: rajeev_shri - Source: Tweet Button

Being abnormal got them where they are...why be normal???The day Apple became normal http://t.co/NEb3VjEN via @FortuneMagazine From: rajeev_shri - Source: Tweet Button

The Apple dividend and stock buy back is probably the first decision Tim Cook has made that Steve Jobs would not have allowed. From: unitedzz8 - Source: web

The Apple dividend and stock buy back is probably the first decision Tim Cook has made that Steve Jobs would not have allowed. From: unitedzz8 - Source: web

RT @joelmsiegel: Apples stunning break with Steve Jobs

http://t.co/81f4ku13 From: CouyonDOTcom - Source: Tweet Button

RT @joelmsiegel: Apples stunning break with Steve Jobs

http://t.co/81f4ku13 From: CouyonDOTcom - Source: Tweet Button

Digital Trends: Apple announces its first dividend and share buy back program since 1995 http://t.co/NHPFYOWM From: tdgnewsfeed - Source: HootSuite

Digital Trends: Apple announces its first dividend and share buy back program since 1995 http://t.co/NHPFYOWM From: tdgnewsfeed - Source: HootSuite

Apple downloads $45bn to shareholders: Biggest company by market value plans first dividend in 17 years and $10bn to be spent buying ... From: DonnaSargent1 - Source: twitterfeed

Apple downloads $45bn to shareholders: Biggest company by market value plans first dividend in 17 years and $10bn to be spent buying ... From: DonnaSargent1 - Source: twitterfeed

RT @GuardianUS: Apple shares cash pile as it launches divident and share buyback scheme http://t.co/Hm8e0Fqz From: judeinlondon - Source: HootSuite

RT @GuardianUS: Apple shares cash pile as it launches divident and share buyback scheme http://t.co/Hm8e0Fqz From: judeinlondon - Source: HootSuite

RT @mlevchin: Saddened by Apples plan for a huge dividend. Apparently, they have nothing truly capital-intensive in the product pipeline. From: ndyroth - Source: TweetDeck

RT @mlevchin: Saddened by Apples plan for a huge dividend. Apparently, they have nothing truly capital-intensive in the product pipeline. From: ndyroth - Source: TweetDeck

"@jimcramer No Disappointment in Apple dividend"//Mother used to get cigarettes from tobacco cos. I could use a free iPad from $AAPL. ;) From: TBSavage - Source: web

"@jimcramer No Disappointment in Apple dividend"//Mother used to get cigarettes from tobacco cos. I could use a free iPad from $AAPL. ;) From: TBSavage - Source: web

#Rex On #Techs: #Apple’s dividend, buyback head up tech #activity: http://t.co/fGFlG138 | #billion From: TibidyBusiness - Source: TibidyBusiness

#Rex On #Techs: #Apple’s dividend, buyback head up tech #activity: http://t.co/fGFlG138 | #billion From: TibidyBusiness - Source: TibidyBusiness

RT @mlevchin: Saddened by Apples plan for a huge dividend. Apparently, they have nothing truly capital-intensive in the product pipeline. From: LFMeghann - Source: TweetDeck

RT @mlevchin: Saddened by Apples plan for a huge dividend. Apparently, they have nothing truly capital-intensive in the product pipeline. From: LFMeghann - Source: TweetDeck

.jpg)